Search The Web

Custom Search

Amazing baby

Watch a baby picks up a napkin with her feet without looking directly at it simply looking in a mirror.

10 Often-Overlooked Tax Breaks

10 Often-Overlooked Tax Breaks from Yahoo News

The goal of every taxpayer is to make sure the Internal Revenue Service gets as little as possible. For that to happen, you need to take every tax deduction, credit or other income adjustment you can.

Here are 10 tax breaks -- some for itemizers only, others that any filer can claim -- that often get overlooked but could save you some tax dollars.

1. Additional charitable gifts

1. Additional charitable gifts

Everyone remembers to count the monetary gifts they make to their favorite charities. But expenses incurred while doing charitable work often aren't counted on tax returns.

You can't deduct the value of your time spent volunteering, but if you buy supplies for a group, the cost of that material is deductible. Similarly, if you wear a uniform in doing your good deeds, for example as a hospital volunteer or youth group leader, the costs of that apparel and any cleaning bills also can be counted as charitable donations.

So can the use of your vehicle for charitable purposes, such as delivering meals to the homebound in your community or taking the Boy Scouts or Girls Scouts troop on an outing. The IRS will let you deduct that travel at 14 cents per mile.

2. Moving expenses

2. Moving expenses

Most taxpayers know they can write off many moving expenses when they relocate to take another job. But what about your first job? Yes, the IRS allows this write-off then, too. A recent college graduate who gets a first job at a distance from where he or she has been living is eligible for this tax break.

3. Job hunting costs

3. Job hunting costs

While college students can't deduct the costs of hunting for that new job across the country, already-employed workers can. Costs associated with looking for a new job in your present occupation, including fees for resume preparation and employment of outplacement agencies, are deductible as long as you itemize. The one downside here is that these costs, along with other miscellaneous itemized expenses, must exceed 2 percent of your adjusted gross income before they produce any tax savings. But the phone calls, employment agency fees and resume printing costs might be enough to get you over that income threshold.

4. Military reservists' travel expenses

4. Military reservists' travel expenses

Members of the military reserve forces and National Guard who travel more than 100 miles and stay overnight for the training exercises can deduct related expenses. This includes the cost of lodging and half the cost of meals. If you drive to the training, be sure to track your miles. You can deduct them on your 2012 return at 55.5 cents per mile, along with any parking or toll fees for driving your own car. You get this deduction whether or not you itemize, but you will have to fill outForm 2106.

5. Child, and more, care credit

5. Child, and more, care credit

Millions of parents claim the child and dependent care credit each year to help cover the costs of after-school day care while Mom and Dad work. But some parents overlook claiming the tax credit for child care costs during the summer. This tax break also applies to summer day camp costs. The key here is that the camp is a day-only getaway that supervises the child while the parents work. You can't claim overnight camp costs.

Remember, too, the dual nature of the credit's name: child and dependent. If you have an adult dependent who needs care so that you can work, those expenses can be claimed under this tax credit.

6. Mortgage refinance points

6. Mortgage refinance points

When you buy a house, you get to deduct the points paid on the loan on your tax return for that year of purchase. But if you refinance your home loan, you might be able to deduct those points, too, as long as you use refinanced mortgage proceeds to improve your principal residence.

7. Many medical costs

7. Many medical costs

Taxpayers who itemize deductions know how difficult it often is to reach the 7.5 percent of adjusted gross income threshold required before you can claim any medical expenses. It might be easier to clear that earnings hurdle if you look at miscellaneous medical costs. Some of these include travel expenses to and from medical treatments, insurance premiums you pay for from already-taxed income and even alcohol- or drug-abuse treatments.

These added medical expenses will be even more valuable on your 2013 tax return. Beginning this tax year, a health care reform act provision now requires you have medical expenses of more than 10 percent of your adjusted gross income before you can deduct them.

Self-employed taxpayers who are not covered by any other employer-paid plan, for example, one carried by a spouse, can deduct 100 percent of health insurance premiums as an adjustment to income in the section at the bottom of Page 1 of Form 1040.

8. Retirement tax savings

8. Retirement tax savings

The retirement savings contribution credit was created to give moderate- and low-income taxpayers an incentive to save. When you contribute to a retirement account, either an individual retirement account (traditional or Roth) or a workplace plan, you can get a tax savings for up to 50 percent of the first $2,000 you put into such accounts. This means you get a $1,000 tax credit, which is a tax break that directly reduces dollar for dollar any tax you owe.

9. Educational expenses

9. Educational expenses

The Internal Revenue Code offers many tax-saving options for individuals who want to further their education. The tuition and fees deduction can help you take up to $4,000 off your taxable income and is available without having to itemize.

The lifetime learning credit could provide some students (or their parents) up to a $2,000 credit.

Don't forget the American opportunity tax credit, which offers a dollar-for-dollar tax break of up to $2,500. This education tax break was created as part of the 2009 stimulus package as a short-term replacement for the Hope tax credit, and was extended through tax year 2017 as part of the American Taxpayer Relief Act of 2012, also known as the "fiscal cliff" tax bill.

10. Energy-efficient home improvements

10. Energy-efficient home improvements

Generous tax breaks for for energy-efficient home improvements expired at the end of 2010, but some homeowners still might be able to pocket a tax credit of up to $500 on their 2012 and 2013 returns, again thanks to a provision in the fiscal cliff bill, for a few common residential energy upgrades.

The bad news is that the tax credit is just a third of what was previously available. You also now must pay attention to specific spending limits, such as $150 for high-efficiency furnaces and boilers, $300 for air conditioners and heat pumps and $200 for replacement windows. And the overall $500 tax credit cap applies to anyone who received any previous energy tax credit since Jan. 1, 2005.

But if you qualify, the tax break is a tax credit, giving you a dollar-for-dollar reduction of your tax bill. And when it comes to taxes, every dollar saved helps.

HOW TO GET THE MAXIMUM TAX REFUND

HOW TO GET THE MAXIMUM TAX REFUND

If you're an early bird, you'll be able to start filing your federal income in less than a week - and you'll want to make sure you can claim all of the tax breaks you deserve.

After the late tax law changes enacted on January 2, the Internal Revenue Service had to update forms and processing systems. But starting January 30, the vast majority of tax filers - more than 120 million U.S. households - should be able to start filing their taxes either electronically or with paper returns.

After the late tax law changes enacted on January 2, the Internal Revenue Service had to update forms and processing systems. But starting January 30, the vast majority of tax filers - more than 120 million U.S. households - should be able to start filing their taxes either electronically or with paper returns.

Here are three tax easy ways to cut down your tax bill and potentially get a much bigger refund:

State sales taxes

You have the choice of which to deduct on your federal return: your state sales tax or your state income tax. You can pick the one that gives you the biggest deduction. This was a perk that expired at the end of 2011, but it's back now for your 2012 taxes! If your state doesn't have an income tax, it's a no brainer: write-off your state sales taxes. If you live in a state with an income tax, crunch the numbers on the sales tax calculator on the IRS website to figure out which will give you the biggest break.

Job-hunting costs

If you were looking for a job in 2012, I hope you kept track of your job-search expenses, including the cost of printing resumes, business cards, mailings, employment-agency fees, food, hotels, cab fares, and travel.

That's pretty much everything related to your job hunt. You can even deduct 55 cents per mile for driving your own car to a job interview, plus parking and tolls. If you were looking for a position in the same line of work, these job-hunting expenses are considered "miscellaneous expenses" and are deductible -- as long as you itemize and your total miscellaneous expenses exceed two percent of your adjusted gross income.

Out-of-pocket charitable deductions

Don't forget to count up your little philanthropic gestures in 2012 as well as big charitable gifts. Look at all of the out-of-pocket expenses that you paid for while doing work for a charity. The pizza, drinks, and desserts you bought for a fundraiser at your kid's school count as a charitable contribution. If you drove your car to Girl Scout or Boy Scout activities or events with another non-profit organization that you are involved in, you can deduct 14 cents per mile, plus parking and tolls.

You'll may soon find your little charitable contributions add up quickly. Just make sure you have documentation to back up these deductions before you file your return.

Once you've whittled down your tax bill, filing electronically is the safest, fastest and easiest way to submit your return. You with these deductions, you may find you'll get back a refund that's even bigger than you expected. If Uncle Sam winds up owing you money, the IRS says you'll get your refund much faster if you e-file and request direct deposit.

See also . . . 10-often-overlooked-tax-breaks

UNLOCKING YOUR SMARTPHONE WILL BE ILLEGAL STARTING NEXT WEEK

The Librarian of Congress determined in October of last year that certain actions involving mobile phones were illegal under the Digital Millennium Copyright Act. The rules were revised to state that while it is legal to jailbreak smartphones, it is illegal to jailbreak tablets and illegal to unlock phones without permission from your wireless provider. A 90-day window was put in place that allowed consumers to purchase a phone and unlock it, however that window closes on January 26th, TechNewsDaily noted. Most carriers lock their phones to prevent them from running on competitors’ networks. Starting next week, U.S. consumers will no longer legally be allowed to unlock their carrier-locked devices without permission, though some smartphones such as Verizon’s iPhone 5 and the Nexus 4 are unlocked to begin with.

THE ABSOLUTE BEST TIME TO BOOK A FLIGHT

I READ FOR YOU, FROM YAHOO FINANCE

Bargain-conscious travelers have been trying to answer the question for years and are still stymied: How far in advance do you have to book to get the best airfare? According to new research by CheapAir.com based on the travel site's review of 560 million airfares, the optimal time to book a domestic flight is 49 days in advance. If you're flying overseas, you should book almost three months -- 81 days, to be precise -- before you travel. Too much planning for you? Don't worry. While the average domestic flight was the cheapest 49 days out, it didn't start to rise dramatically in price until about two weeks before the departure date. But if you wait until the day or two before you want to travel, get ready for some serious pocketbook pain. Domestic flights that would normally cost less than $400 jump to about $625. Notably, it's also bad for your pocketbook to book too far in advance, according to CheapAir. People who booked 210 days before the flight ended up paying an average of $475 for a domestic ticket. There are exceptions and caveats, however. If you're booking for a high-traffic time, like Thanksgiving, it can make sense to book well in advance. The optimal time to buy a flight for Thanksgiving weekend in 2012, for instance, was 96 days in advance. If you're taking an international flight, by contrast, you might score a real bargain by being spontaneous. For example, the best price CheapAir found for a Los Angeles-to-Tokyo flight was when the traveler booked one day before the flight. Other factoids of note: Booking a flight on a Tuesday or Wednesday is not likely to save any money. But flying on a Tuesday or Wednesday will. And, of course, while this study focuses on average ticket prices, there are a lot of one-time deals that can make booking at any given time either a bargain or a bust. CheapAir tries to deal with the frustrations of variable airline pricing by offering a customer payback program. If you book a flight through the site and find that your specific itinerary has dropped in price, it offers you up to a $100 credit for another flight. And what if another airline offers a better deal in the meantime? Unless you're traveling on one of the rare airlines, such as Southwest, that will allow you to change your ticket without penalty, you're out of luck.

Bargain-conscious travelers have been trying to answer the question for years and are still stymied: How far in advance do you have to book to get the best airfare? According to new research by CheapAir.com based on the travel site's review of 560 million airfares, the optimal time to book a domestic flight is 49 days in advance. If you're flying overseas, you should book almost three months -- 81 days, to be precise -- before you travel. Too much planning for you? Don't worry. While the average domestic flight was the cheapest 49 days out, it didn't start to rise dramatically in price until about two weeks before the departure date. But if you wait until the day or two before you want to travel, get ready for some serious pocketbook pain. Domestic flights that would normally cost less than $400 jump to about $625. Notably, it's also bad for your pocketbook to book too far in advance, according to CheapAir. People who booked 210 days before the flight ended up paying an average of $475 for a domestic ticket. There are exceptions and caveats, however. If you're booking for a high-traffic time, like Thanksgiving, it can make sense to book well in advance. The optimal time to buy a flight for Thanksgiving weekend in 2012, for instance, was 96 days in advance. If you're taking an international flight, by contrast, you might score a real bargain by being spontaneous. For example, the best price CheapAir found for a Los Angeles-to-Tokyo flight was when the traveler booked one day before the flight. Other factoids of note: Booking a flight on a Tuesday or Wednesday is not likely to save any money. But flying on a Tuesday or Wednesday will. And, of course, while this study focuses on average ticket prices, there are a lot of one-time deals that can make booking at any given time either a bargain or a bust. CheapAir tries to deal with the frustrations of variable airline pricing by offering a customer payback program. If you book a flight through the site and find that your specific itinerary has dropped in price, it offers you up to a $100 credit for another flight. And what if another airline offers a better deal in the meantime? Unless you're traveling on one of the rare airlines, such as Southwest, that will allow you to change your ticket without penalty, you're out of luck.

The best way to treat a headache

The best way to treat a headache

Headaches are the body's way of letting you know that there's something wrong somewhere in your body. But sometimes the pain is so bad that all you want is for it to stop.

So, what is the best way to stop the pain.

Is it really by taking pills or is there any other way?. People in Nigeria found the answer.!

So, If you have a headache or know someone whose having it, just let them watch this video and their headache will disappear:

THIS IS THE BEST KNOWN WAY TO TREAT YOUR HEADACHE

Headaches are the body's way of letting you know that there's something wrong somewhere in your body. But sometimes the pain is so bad that all you want is for it to stop.

So, what is the best way to stop the pain.

Is it really by taking pills or is there any other way?. People in Nigeria found the answer.!

So, If you have a headache or know someone whose having it, just let them watch this video and their headache will disappear:

THIS IS THE BEST KNOWN WAY TO TREAT YOUR HEADACHE

Labels:

The best way to treat a headache

Top City for Bedbugs Named

Bedbugs are on the rise again in the U.S., which means business is booming for pest control companies like Orkin.

With increased travel, both internationally and domestically, and higher bedbug resistance to existing pesticides, Orkin has seen an almost 33 percent boost in bedbug business compared to 2011.

The company has just released its rankings of U.S. cities in order of the number of bedbug treatments from January to December 2012. The "Windy City" of Chicago tops the list, followed by Detroit, Los Angeles, Denver and Cincinnati.

"This list shows that bedbugs continue to be a problem throughout the U.S.," Ron Harrison, Ph.D., Orkin entomologist and Technical Services Director said in a statement. "Based on the diversity of cities on the list, we all need to be very cautious when we travel - whether it is business or pleasure, or to visit family, friends or vacation."

Bedbugs are about the size and color of a flat apple seed, and are found not only on mattresses and upholstery, but in suitcases, boxes, shoes, wallpaper and headboards.

Harrison stresses that it's important to be vigilant and take proper precautions wherever you are. It's a common misconception that sanitation is a factor in developing the tiny pests, Orkin says.

Here are the top 50 U.S. cities, ranked in order of the number of bedbug treatments. The number in parenthesis is the shift in ranking compared to January to December 2011:

Chicago (+1)

Detroit (+1)

Los Angeles (+2)

Denver

Cincinnati (-4)

Columbus, Ohio

Washington, D.C. (+1)

Cleveland/Akron/Canton (+5)

Dallas/Ft. Worth (-2)

New York (-1)

Dayton, Ohio (+4)

Richmond/Petersburg, Va. (-2)

Seattle/Tacoma (+14)

San Francisco/Oakland/San Jose (-2)

Raleigh/Durham/Fayetteville, N.C. (+4)

Indianapolis (+15)

Omaha, Neb. (+11)

Houston (-7)

Milwaukee (+13)

Baltimore (-2)

Syracuse, N.Y. (+2)

Boston (-8)

Colorado Springs/Pueblo, Colo. (+2)

Lexington, Ky. (-2)

Miami/Ft. Lauderdale (-1)

Hartford/New Haven, Conn. (+10)

Knoxville, Tenn. (+11)

Buffalo, N.Y. (+1)

Atlanta (-8)

Louisville, Ky. (+5)

Charleston/Huntington, W. Va. (+18)

San Diego, Calif. (-6)

Cedar Rapids/Waterloo, Iowa (+12)

Minneapolis/St. Paul (+12)

Phoenix (-1)

Pittsburgh (-6)

Honolulu (-19)

Grand Rapids/Kalamazoo, Mich. (+1)

Grand Junction/Montrose, Colo. (-1)

Nashville, Tenn.

Lincoln/Hastings/Kearney, Neb. (+7)

Albany/Schenectady/Troy, N.Y. (+2)

Charlotte (-10)

Tampa/St. Petersburg, Fla.

Sacramento/Stockton/Modesto, Calif. (-4)

Las Vegas (-30)

Greenville/Spartanburg/Asheville, S.C.

Champaign/Springfield, Ill.

Portland, Or.

Sioux City, Iowa

Labels:

Top City for Bedbugs Named

Bedbugs are on the rise again in the U.S., which means business is booming for pest control companies like Orkin.

With increased travel, both internationally and domestically, and higher bedbug resistance to existing pesticides, Orkin has seen an almost 33 percent boost in bedbug business compared to 2011.

The company has just released its rankings of U.S. cities in order of the number of bedbug treatments from January to December 2012. The "Windy City" of Chicago tops the list, followed by Detroit, Los Angeles, Denver and Cincinnati.

"This list shows that bedbugs continue to be a problem throughout the U.S.," Ron Harrison, Ph.D., Orkin entomologist and Technical Services Director said in a statement. "Based on the diversity of cities on the list, we all need to be very cautious when we travel - whether it is business or pleasure, or to visit family, friends or vacation."

Bedbugs are about the size and color of a flat apple seed, and are found not only on mattresses and upholstery, but in suitcases, boxes, shoes, wallpaper and headboards.

Harrison stresses that it's important to be vigilant and take proper precautions wherever you are. It's a common misconception that sanitation is a factor in developing the tiny pests, Orkin says.

Here are the top 50 U.S. cities, ranked in order of the number of bedbug treatments. The number in parenthesis is the shift in ranking compared to January to December 2011:

Chicago (+1)

Detroit (+1)

Los Angeles (+2)

Denver

Cincinnati (-4)

Columbus, Ohio

Washington, D.C. (+1)

Cleveland/Akron/Canton (+5)

Dallas/Ft. Worth (-2)

New York (-1)

Dayton, Ohio (+4)

Richmond/Petersburg, Va. (-2)

Seattle/Tacoma (+14)

San Francisco/Oakland/San Jose (-2)

Raleigh/Durham/Fayetteville, N.C. (+4)

Indianapolis (+15)

Omaha, Neb. (+11)

Houston (-7)

Milwaukee (+13)

Baltimore (-2)

Syracuse, N.Y. (+2)

Boston (-8)

Colorado Springs/Pueblo, Colo. (+2)

Lexington, Ky. (-2)

Miami/Ft. Lauderdale (-1)

Hartford/New Haven, Conn. (+10)

Knoxville, Tenn. (+11)

Buffalo, N.Y. (+1)

Atlanta (-8)

Louisville, Ky. (+5)

Charleston/Huntington, W. Va. (+18)

San Diego, Calif. (-6)

Cedar Rapids/Waterloo, Iowa (+12)

Minneapolis/St. Paul (+12)

Phoenix (-1)

Pittsburgh (-6)

Honolulu (-19)

Grand Rapids/Kalamazoo, Mich. (+1)

Grand Junction/Montrose, Colo. (-1)

Nashville, Tenn.

Lincoln/Hastings/Kearney, Neb. (+7)

Albany/Schenectady/Troy, N.Y. (+2)

Charlotte (-10)

Tampa/St. Petersburg, Fla.

Sacramento/Stockton/Modesto, Calif. (-4)

Las Vegas (-30)

Greenville/Spartanburg/Asheville, S.C.

Champaign/Springfield, Ill.

Portland, Or.

Sioux City, Iowa

Unborn Child Saves Fathers Life

Unborn Child Saves Fathers Life

Do you believe in Miracles? Or the Supernatural? Well maybe you will start after you here this story. In this case, in a story out of Atlanta, Georgia, a baby saved his father’s life before he was even born.

According to Sara McDonald, who is 7 1/2 months pregnant, her husband, Thomas, wouldn’t be here today if her baby hadn’t given her a very powerful sign that something was wrong — a big kick. She says that kick from her baby, Cameron, jolted her out of a deep sleep where she found her husband unresponsive.

According to Sara McDonald, who is 7 1/2 months pregnant, her husband, Thomas, wouldn’t be here today if her baby hadn’t given her a very powerful sign that something was wrong — a big kick. She says that kick from her baby, Cameron, jolted her out of a deep sleep where she found her husband unresponsive.

She told the station he didn’t have a heartbeat and that he was “purple from the waist up.” She was, understandably, terrified and called police after trying to perform CPR herself. Officers say they weren’t sure he would make it, but fortunately he did, and he’s going to be fine.

McDonald has no doubt that her unborn son was responsible: “It’s like my baby saved my husband’s life. And he’s not even here yet and he saved his dad’s life. It’s an amazing feeling and I don’t think anyone else can say that.”

She talks more about the story in a video interview.

Labels:

Unborn Child Saves Fathers Life

Did Google kill a donkey?

Did Google kill a donkey?

Screenshot from Kweneng, Botswana [Google Street View].A photo from Google's Street View in Botswana went viral after one Twitter user raised concerns about a donkey lying in the middle of a dirt road.

As netizens dissected the Street View images, the online debate prompted Google to deny allegations that the donkey was hurt.

Google's Street View has recently expanded to include countries and territories around the world,coming to Botswana last February.

Labels:

Did Google kill a donkey?

Its So Stupid' -Its Funny..

I need to make one of these for my sisters bunny!!! He acted so sweet... circling me a bunch of times... then finally he jumped into my lap!! And still I thought he was so cute!!! Until he left! I was looking for my phone that was right next to me and I realized that everything was wet!!! That dang bunny peed on me!!!!

Labels:

Its So Stupid Its Funny

Anderson Cooper 360’s RidicuList.

Anderson Cooper 360’s RidicuList.

The hilarious things that happen when news anchors forget they're on TV. When they realize what they've done, the universal response is a resounding "WHAT?!" #LMAO #LOL

Labels:

Anderson Cooper 360s RidicuList

Kushma Gyadi Suspension Bridge

Kushma Gyadi Suspension Bridge

Type: Suspended (Open Type)

Length: 344 meters

Height: 135 meters

Capacity: 108 Tonnes/ 1800 people

Inaugurated: 8th February, 2010 (24th Falgun, 2066 BS)

Man, I a so scared of heights that I feel a little sick just looking at how hight this bridges is!

#ThingsToDoBeforeYouDie

Type: Suspended (Open Type)

Length: 344 meters

Height: 135 meters

Capacity: 108 Tonnes/ 1800 people

Inaugurated: 8th February, 2010 (24th Falgun, 2066 BS)

Man, I a so scared of heights that I feel a little sick just looking at how hight this bridges is!

#ThingsToDoBeforeYouDie

Labels:

Kushma Gyadi Suspension Bridge

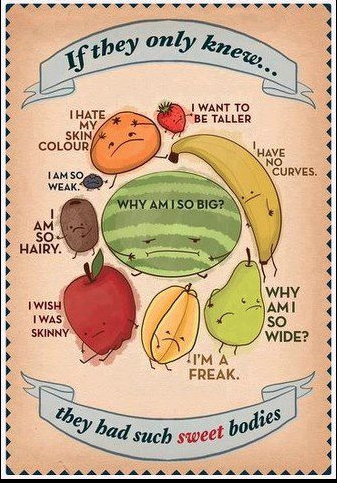

If They Only Knew..

If They Only Knew..

We can pretty much relate this picture to our lives.The way most of us look down on ourselves. We may have ups and downs in our lives.

But that doesn't mean we have to call ourselves "Losers" or "Failures." Everyone is unique in their way..

.

If you ever come across a person who calls you UGLY(most likely yourself...)...Just remind them what it stands for...U Gotta Love Yourself ! :)

But you may dislike something which is good for you, and you may like something which is bad for you. GOD knows while you do not know.

We can pretty much relate this picture to our lives.The way most of us look down on ourselves. We may have ups and downs in our lives.

But that doesn't mean we have to call ourselves "Losers" or "Failures." Everyone is unique in their way..

.

If you ever come across a person who calls you UGLY(most likely yourself...)...Just remind them what it stands for...U Gotta Love Yourself ! :)

But you may dislike something which is good for you, and you may like something which is bad for you. GOD knows while you do not know.

Labels:

If They Only Knew

Heinz Ketchup Calories

Hey, friends today I read this interesting article at http://www.livestrong.com about how much ketchup is contributing to your daily calorie intake!! I thought I would share for those of you who made a new years resolution to lose weight in 2013

Heinz Ketchup Calories

Heinz Ketchup Calories

If you are trying to watch what you eat, then watch out for ketchup!!! Knowing the number of calories per serving of ketchup is adding to your daily diet is important. A bit of nutrition information can help you decide whether opening that Ketchup packet is really worth it.

Heinz Ketchup Calories

Heinz Ketchup CaloriesIf you are trying to watch what you eat, then watch out for ketchup!!! Knowing the number of calories per serving of ketchup is adding to your daily diet is important. A bit of nutrition information can help you decide whether opening that Ketchup packet is really worth it.

Serving Size: 1 tablespoon.

Yet you may be using much more than 1 tablespoon of ketchup to dip your fries.

Caloric Content: 20 calories.

For someone on a 2,000-calorie-per-day diet, this is equivalent to 1 percent, per ketchup packet, of the total daily calories. Remember most people I see use way more than one ketchup packet with their meal!!

Carbohydrates: Every 1 tablespoon serving contains 5g of carbs.

That is 2 percent of the recommended daily value for someone on a 2,000-calorie diet. This is due to the fact that ketchup contains sweeteners such as high fructose corn syrup and corn syrup, Heinz ketchup does contain a small amount of carbohydrates. which represents The majority of the carbohydrates in Heinz ketchup -- 4g of the 5g -- are sugars.

Sodium: Every serving of the ketchup contains 160 mg of salt.

That represents 7 percent of the recommended daily salt intake value for someone on a 2,000-calorie diet. So moral of the story is, if you are trying to lose weight, STOP EATING KETCHUP!! Or at least limit the amount of ketchup you eat to one packet!!!

References

- Heinz Ketchup Product Gallery

- DietFacts.com: Heinz Tomato Ketchup Nutrition Facts

- Livestrong.com: Heinz ketchup Nutrition Information

- USDA Dietary Guidelines for Americans: How Much Are You Eating?

Labels:

Heinz Ketchup Calories

characteristics of people who live to age 100

A growing number of Americans are living to age 100. Nationwide, the centenarian population has grown 65.8 percent over the past three decades, from 32,194 people who were age 100 or older in 1980 to 53,364 centenarians in 2010, according to new Census Bureau data. In contrast, the total population has increased 36.3 percent over the same time period.

Centenarians in the United States are considerably different from the overall population. Here's a look at some of the characteristics of people who live to age 100:

Female Gender

It is overwhelmingly women who live to age 100. In 2010, 82.8 percent of centenarians were female. For every 100 females age 100 or older, there are only 20.7 males the same age. Females also make up 61.9 percent of those in their 80s and 72.2 percent of people in their 90s. "We know that women are more social than men. Other studies have found that staying socially connected predicts greater life expectancy," says Gary Small, a professor on aging and director of the UCLA Longevity Center in Los Angeles, who is not affiliated with the Census Bureau report. "If you are social, it may reduce stress levels because you can talk about your feelings and things that stress you out and it seems to help many people. If you need a ride to the doctor or you fall, they can take you to the hospital or help you find the best doctor."

Less Diversity

Centenarians are considerably less diverse than the overall U.S. population. In 2010, some 82.5 percent of centenarians were white, versus 72.4 percent of the total population. Black or African Americans were unique in that their proportion of the centenarian population (12.2 percent) is about the same as their percentage of the total population (12.6 percent). Asians made up 2.5 percent of the centenarian population, while they make up 4.8 percent of the total population. And Hispanics represent 5.8 percent of centenarians, but 16.3 percent of the population.

Living with Others

Just over a third of both female and male centenarians lived alone in their own home in 2010, but the majority of the oldest citizens live with others. "As people get older, things in life happen—like you might become a widow or you might have a disability, and because of those circumstances, living arrangements often change," says Amy Symens Smith, chief of the age and special populations branch at the Census Bureau. Centenarian females (35.2 percent) were more likely to live in a nursing home than males the same age (18.2 percent). Centenarian males are the most likely to be living with others in a household (43.5 percent), compared to just 28.5 percent of centenarian females.

City Living

A large majority of the oldest U.S. citizens live in urban areas. "As age increases, the percentage living in urban areas also increases," says Smith. Some 85.7 percent of centenarians lived in urban areas in 2010, compared with 84.2 percent of those in their 90s, 81.5 percent of those in their 80s, and 76.6 percent of those in their 70s. "Living in the city, you have a lot more mental stimulation and the symphony and better doctors and hospitals and more social networking," says Small. "There are more resources, and there is better transportation."

Located in the Northeast or Midwest

States with the largest populations generally have the most centenarians. California has the largest number of centenarians (5,921), followed by New York (4,605), Florida (4,090), and Texas (2,917). Alaska has the fewest residents age 100 and older (40). Wyoming (72), Vermont (133), and Delaware (146) are also among the states with the fewest centenarians.

The Northeast and Midwest have proportions of centenarians that are higher than the national average of 1.73 per 10,000 people, while the West and South have below-average proportions of centenarians. "There's a lot of stuff going on in local areas, including access to medical care, diet, exercise, the culture, risk-taking, and more smoking," says Linda Waite, a sociology professor and director of the Center on Aging at the University of Chicago. "People in the Northeast tend to be more highly educated, and education is associated with a longer life expectancy." North Dakota is the only state with more than 3 centenarians for every 10,000 people in the state. Other states where centenarians make up a relatively large portion of the population include South Dakota, Iowa, and Nebraska. Three western states have less than one centenarian for every 10,000 people: Alaska, Utah, and Nevada.

The proportion of centenarians in the United States is smaller than that of many other developed countries. For example, for every 10,000 people, there are 1.92 centenarians in Sweden, 1.95 in the United Kingdom, and 2.70 in France. And Japan has 3.43 centenarians per 10,000 people, beating even our longest-lived state, North Dakota.

Subscribe to:

Posts (Atom)

PLEASE VISIT OUR SISTER SITE ...

IF YOU LIKED THIS YOU MAY LIKE ......

- #BLIND #JOKE #ACNE #LMAO (1)

- #JOKE #POOR #CHEAP #LMAO (1)

- #JURY #PROBLEM #JOKES #LMAO #TEAMFOLLOWBACK (1)

- #LAWYER #JOKE #HEAVEN #LMAO (1)

- 000 in scholarship money for college More information here (1)

- A CAT THAT GREW WINGS (1)

- A HAND IN THE SKY (1)

- A machine picks an Olive tree (1)

- A MAZING PALACE IN SPAIN (1)

- AMAZING FACE TRANSPLANT (1)

- AMAZING PHOTO OF Marilyn Monroe (1)

- Anderson Cooper 360s RidicuList (1)

- Bangal cat (1)

- Blonde joke lmao (1)

- cakes (1)

- characteristics of people who live to age 100 (1)

- child (1)

- children (1)

- China is planning to hold a robot Olympics in 2010 (1)

- CLIFTON PARK (1)

- corn and blck bean pizza (1)

- DAYLIGHT TIME SAVINGS (1)

- Depends Prank (1)

- Did Google kill a donkey Video Proof (1)

- Did Google kill a donkey? (1)

- diet food (1)

- DIET SODA MAY INCREASE YOUR RISK OF TYPE 2 DIABETES (1)

- EN-V (1)

- Expecting parents (1)

- Farouk FOR GOVERNEER OF TEXAS (1)

- First Monday Trade Days in Canton Texas (1)

- Fix your hijacked web browser (1)

- fleamarket (1)

- FOOD (1)

- FROM RAP MUSIC TO BEING A MUSLIM (1)

- funny (1)

- Funny old people (1)

- Funny twitter suggestion (1)

- GM electronic car that can drive itself (1)

- Google Street View Car Plows Down Deer (1)

- Google's Street View captures privacy critic LAWYER Smoking (1)

- Heinz Ketchup Calories (1)

- How real men bake (1)

- HOW TO GET THE MAXIMUM TAX REFUND (1)

- How to Get Your Insurer to Pay Your Hurricane Irene Claim (1)

- If They Only Knew (1)

- India To Allow Cow Urine As Soft drink (1)

- is 23 years old from Brooklyn (1)

- IT IS TOO HARD TO BE THE MALE (1)

- Its So Stupid Its Funny (1)

- joke (1)

- Kushma Gyadi Suspension Bridge (1)

- Leap of faith water slide Atlantis resort the Bahamas (1)

- Life lessons (1)

- Look Who's Here (1)

- Lose 7lbs a week on a new doctor Oz diet (1)

- LOST HISTORY IN DETROIT MICHIGAN (1)

- make me a sandwich (1)

- Mallory Hagan (1)

- Merciful storekeeper changes robber's mind (1)

- Most Embarrassing moments (1)

- Muslim Student Association (1)

- New Miss America (1)

- New York (1)

- NY She won 50 (1)

- Opportunities that an MBA degree could offer (1)

- Out of this World Lawn Mower (1)

- Palm Baygraffiti artist runs out of paint (1)

- Parasites (1)

- Passive Income Tax benefits (1)

- ragdol cat (1)

- Saudi Arabia's Beauty Pageant (1)

- SPY IN THE SKY (1)

- Swiss Politician Bans Minarets then Converts to Islam (1)

- T.G.I. Friday's restaurant (1)

- TALLEST TOWER IN THE WORLD (1)

- Teacher Goes Crazy (1)

- TEXAS CITIES POPULA LISTED BY ALPHABETS (1)

- TEXAS CITIES POPULATION LISTED BY NUMBER (1)

- TEXAS COUNTIES POPULATION (1)

- THE ABSOLUTE BEST TIME TO BOOK A FLIGHT (1)

- The best way to treat a headache (1)

- The Times Union of Albany (1)

- This is the future of computers (1)

- Top City for Bedbugs Named (1)

- Unborn Child Saves Fathers Life (1)

- UNLOCKING YOUR SMARTPHONE WILL BE ILLEGAL STARTING NEXT WEEK (1)

- upstate New York (1)

- Wedding (1)

- What can you do with your coffee cups (1)

- When PMS and GPS mix (1)

- Why would you wake me up (1)

- Wi-fi N Router N300 belkin (1)

- لقطة قراءة الفاتحه من زيدان و الجزائري عنتر يحيى قبل مباراة Zidan reads ALFATIHA before the game (1)

Popular Posts

-

HOW TO GET THE MAXIMUM TAX REFUND If you're an early bird, you'll be able to start filing your federal income in less than a...

-

Hey, friends today I read this interesting article at http://www.livestrong.com about how much ketchup is contributing to your daily calorie...

-

Lose 8lbs/week!! By drinking coffee made with natural green coffee bean! It is said to be a Potent Fat Burner, Effective Appetite Suppressan...

-

لكل الجماعة اللي قاعدين يسوو رياضه يوميه وتمارين..نقول لو كان المشي زين للصحة كان راعي البريد أحسن صحة بالعالم.. الحوت يسب...

-

I READ FOR YOU, FROM YAHOO FINANCE Bargain-conscious travelers have been trying to answer the question for years and are still stymied: H...

-

Today I was looking for the best adwords to include in your blog to maximize your potential earnings. Ofcourse there is no one really knows...

-

find out for yourself if you have any unclaimed property or unclaimed money in Texas. just plug in your first and last name here is the o...

-

10 Often-Overlooked Tax Breaks from Yahoo News The goal of every taxpayer is to make sure the Internal Revenue Service gets as little ...

FOLLOW ME ON TWITTER

EVERYTHING ABOUT TEXAS

Barbara Olson

Houston

Houston Texans

Lee Harvey Oswald

Republic of Texas

Robert Rodriguez

Roger Clemens

Spindletop

Texas

Enron

Republic of Texas

Texas Revolution

Texas Revolution

Rio Grande

7-Eleven

Texas Longhorn (cattle)

Fort Worth, Texas

San Antonio

Borland

George McFarland

Selena

Jerome Napoleon Bonaparte II

Manifest Destiny

Bill Hicks

Arlington, Texas

List of counties in Texas

Brazos County, Texas

Wise County, Texas

Anderson County, Texas

Angelina County, Texas

Aransas County, Texas

Archer County, Texas

Atascosa County, Texas

Austin County, Texas

Armstrong County, Texas

Bailey County, Texas

Bandera County, Texas

Bastrop County, Texas

Baylor County, Texas

Bee County, Texas

Bell County, Texas

Bexar County, Texas

Blanco County, Texas

Bosque County, Texas

Bowie County, Texas

Brazoria County, Texas

Brewster County, Texas

Briscoe County, Texas

Brooks County, Texas

Brown County, Texas

Burleson County, Texas

Burnet County, Texas

Caldwell County, Texas

Calhoun County, Texas

Callahan County, Texas

Cameron County, Texas

Camp County, Texas

Carson County, Texas

Cass County, Texas

Castro County, Texas

Chambers County, Texas

Cherokee County, Texas

Childress County, Texas

Clay County, Texas

Dell

Rockwall County, Texas

Cochran County, Texas

Coke County, Texas

Coleman County, Texas

Collin County, Texas

Collingsworth County, Texas

Colorado County, Texas

Comal County, Texas

Comanche County, Texas

Concho County, Texas

Cooke County, Texas

Coryell County, Texas

Cottle County, Texas

Crane County, Texas

Crockett County, Texas

Crosby County, Texas

Culberson County, Texas

Dallam County, Texas

Dallas County, Texas

Dawson County, Texas

Deaf Smith County, Texas

Delta County, Texas

Denton County, Texas

DeWitt County, Texas

Dickens County, Texas

Dimmit County, Texas

Donley County, Texas

Duval County, Texas

Eastland County, Texas

Ector County, Texas

Edwards County, Texas

El Paso County, Texas

Ellis County, Texas

Erath County, Texas